Thinking To Never Retire But Are You Prepared For It?

Psst…have you heard the buzz about Never Retire? Perhaps you’re even considering it?

Funny how not too long ago, the FIRE movement was all the rage. Bloggers, FIRE practitioners and media articles touted the benefits and rationale of such a lifestyle choice. Many embrace it as a covert rebellion to stressful work life. It offers an early escape from corporate enslavement, of hours in cheerless rooms with politicking colleagues and ruthless management.

Fast forward to 2024 and FIRE has lost its lustre. Its detractors found post-work life not the bed of roses they envisaged. The FIRE path is too restrictive, requiring too many sacrifices and denials during one’s prime years. Some re-discovered the benefits of work while others regretted the slide into insignificance, from being ‘somebody’ to ‘nobody’, prematurely.

The pendulum seems to have swung to the other extreme – to Never Retire.

Why Never Retire?

‘Never retire’ advocates continued employment beyond retirement age, challenging its traditional concept. This phenomenon stamps not only from personal motivations, but also supported by societal and economic factors.

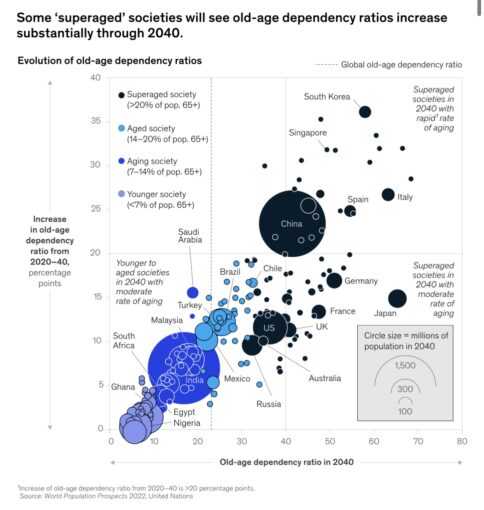

- Increased Life Expectancy: We are living longer than ever before, aided by advancements in healthcare and technology. The Harvard Gazette claims that the first human to live to 150 years is already in our midst. Many who reach retirement age have decades of health span ahead. This longevity deserves a reevaluation of retirement age.

- Nature of work: Work itself has morphed, offering flexibilities such as WFH, part-time work, job-sharing and better work-life balance. These make it easier to continue working, if not full-time then part-time or on project basis.

- Financial Stability: Factors that affect retirement include savings, unexpected expenses, health, inflation and economic downturns. The unpredictability of modern life, together with with longevity and health, makes continued work and the cash flow generated attractive.

- Health and Well-being: Research suggests that staying mentally and physically active promote overall health and well-being. Cognitive stimulation, social interaction and structured routines are all crucial for mental acuity and emotional health.

- Lifestyle Choices: More individuals are embracing the joy of work, choosing to Never Retire. Warren Buffet (93), the most successful investor of our era, continues to helm Berkshire Hathaway, the investment company he co-founded with Charlie Munger (who retired when he died at 99 last November), US President Joe Biden (81), actor/director Clint Eastwood (93), former Malaysian prime minister Dr Mahathir Mohamad (98)…to name a few. They are prime examples that 100 is the new 80!

- Social Interaction: Workplaces often serve as hubs for social interaction and camaraderie. By staying engaged in the workforce, one continues to cultivate relationships, reducing the risk of social isolation.

- Personal Fulfilment: Many people derive fulfilment, sense of purpose and achievement from work. Let’s face it, few other places can provide such rewards. Work allows one to contribute meaningfully, be part of a team and learn new skills.

Modern Retirement

I love the notion of Never Retire as long as it is by choice instead of necessity. It is 1 of the 6 retirement options, giving empowerment to those who prefer non-traditional retirement. To Never Retire is to take control and live life on your terms instead of acceding to social norms, expectation or legislation. As long as you are able and want to work, why not

The idea of retirement is changing and will continue to change as it adapts to the needs and desires of people, just like how the concept of work is evolving. Modern retirement extends beyond simply stopping work. It means to have the time, freedom and financial ability to do what you enjoy, such as working part-time or in a role less stressful.

Preparedness

But how should you prepare to Never Retire? Despite its moniker, retirement planning is still crucial to ensure you do to outlive your funds when you eventually stop work. Your health may deteriorate, maybe retrenched or need to take care of your ailing spouse.

So even if you plan to Never Retire, you should think about setting aside a portion of your income to create passive income streams during the extended work years. You stand to gain more from longer compounding effect, as you let time do the heavy lifting of wealth building.

As an advocate of FIRM over FIRE, I encourage learning simple yet proven stock investment strategies which do not require much time or effort.

If stocks and share are not your cuppa tea, you can look into investing in real estate by deploying a strategy according to the phase of your life. Real estate is 1 of the best inflation hedge, in addition to being repeatable and generates stable cashflow. You will need to be aware of when to sell an investment property and have an exit strategy though, to protect your gains .

Priority should also be accorded for an insurance portfolio that suits your needs, especially for later years when you are no longer able to work. 1 of the most crucial is Long-Term Care insurance as well as an understanding of the relevance of term life or whole life insurance for your particular situation. Under-coverage will come back to haunt you while over-coverage drains your hard-earned resources without adding value.

One Last Thing

In the spirit of leaving the best for last – health, which is the real wealth. While the desire may be to Never Retire, it is completely dependent on your health. A healthy lifestyle is built from daily habits, which compound over years to produce life enhancing effects.

As the idea to Never Retire takes stronger hold in society, it bears remembering that retirement planning remains a critical part. The likelihood of working up to the last breadth is a rare occurrence, so don’t leave anything to chance. Your older self will thank you for this foresight as you take on retirement on your own terms.

Never say never,

Savvy Maverick

(Main image: Peggy Sue Zinn, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Do make independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.