Your Forever Home May Not Be Your Eventual Living Arrangement

A forever home conjures up warm fuzzy images of a sanctuary where we feel safe, happy and comfortable for the rest of our lives. A living arrangement where we can create cosy memories, feel secure and grounded, with peace-of-mind knowing it caters to our long-term needs.

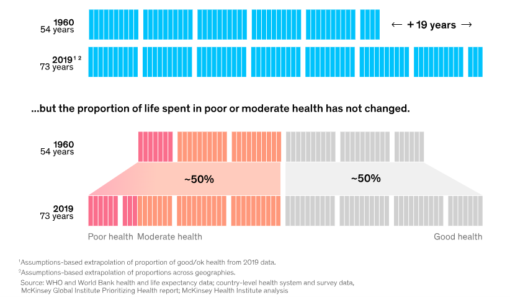

However, what we have in mind may not be in sync with reality, especially with increasing longevity, longer time spent in poor health, rising costs and dwindling support structure. While ageing-in-place is preferred and encouraged in most countries, we should wise up to the fact that our health will dictate our eventual living arrangement.

Global Trends

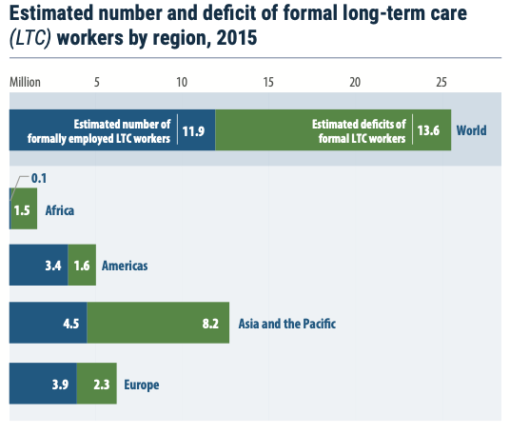

The global trend is that people are living longer but in many cases, the support system to care for older people is lacking. A global study by UN showed the gaps between number of formally employed long-term care workers (LTC) vs the estimated shortage by region. I imagine these deficits will grow given the time it takes to attract and train a professionally qualified long-term worker.

Even in Asia, where traditional caregivers for the elderly are assumed to be younger family members, this model is breaking down. Family dynamics and living arrangements are fast changing: family units are getting smaller, families are living further apart, the rise of dual-income families which means no care-giver at home and increase in singlehood.

Wishful Thinking

In light of these shifts, we either start planning for our own living arrangement in old age or leave it to chance. The latter means having to accept whatever the outcome, which will likely not be to our desire. So the sooner we accept this reality and start taking charge of our own destiny, the better.

My late mother-in-law had planned on ageing-in-place in her forever home of more than 50 years. Robust and free of illness her entire life, her health took a dive after she turned 90, requiring constant oxygen supply. She had no choice but to relocate to an assisted living facility. As she had not registered prior, she was in an interim home for almost 2 months while waiting for availability.

My husband’s godfather, a retired professor who turned 97 recently, had insisted on ageing-in-place. He had regular home-nursing visits and could afford a personal helper who came by thrice weekly. However, after suffering 3 falls within 2 months, he finally relented. Luckily, armed with the experience of his own mother, my husband was able to jump through loops and hoops to secure him a place at a reputable serviced apartment catering to the elderly, in a timely manner.

So it’s not a case of what we want or how financially prepared we are, but a case of ability…or inability, in these instances.

Living Arrangement

The world has not seen such rate and scale of ageing as what we are experiencing now. Given the lack of precedents and seeing how ill-prepared my late mother-in-law and my husband’s godfather were, I will approach mine differently.

Assess Needs:

Start by evaluating my future needs and consider factors such as environment, health condition, mobility, cognitive abilities, family support and amenities.

Location:

I’m in a transnational marriage so my concept of ‘home’ is blurred. Will I return to my home country Singapore eventually? If so, I need to stay abreast of living arrangements options there too. For most though, location would mean proximity to family, friends, available options, desired amenities and budget. The chosen location should meet my social, emotional and practical needs.

Research Options:

Being aware of living arrangement options is the first step in research. Explore how each can cater to my needs. Besides commercially operated facilities, I find the informal co-living arrangement with friends quite appealing. Co-living means growing old together with people I know, pooling our resources for shared costs like a communal kitchen, a helper, nurse or cook to provide us with the care and help we need.

Budget:

Develop a financial plan to cover the expenses of my chosen option. Resources will be from my savings, retirement income, pensions and long-term care insurance. Standards and costs can differ greatly across locations, across categories and even within category.

Tour Facilities:

Visit potential facilities to assess the amenities, environment, staff, cleanliness and atmosphere. Find out the level of care provided, available services, recreational activities, meal options and safety features.

Discuss Preferences:

In my case, the decision will be made jointly with my S.O. If you have children or are single, you may want to discuss with other family members or close friends, especially if your preference is for co-living. Consider their input and involve them in the decision-making process, if appropriate.

Legal and Estate Planning:

Update legal documents such as my will, power of attorney and advance medical directive to reflect my living arrangement decision. If you haven’t done so, I would suggest writing a will as it gives clarity to your life.

Transition Plan:

Decide on when I would want to move into the living arrangement and develop a transition plan. This may involve selling the home, which is why regular decluttering is a good habit.

Stay Informed:

Keep myself informed and updated of changes in living arrangements. Especially in the area of technological advancement, the rapid development in AI could mean re-imagining retirement altogether, opening up new options that are not available yet.

Keep Updated:

My personal circumstance will evolve over time in terms of health, financial situation or personal and family situation. Re-assess my living arrangement decision every 2-3 years or when there is a significant life change. This way, my changing needs and preferences can be met.

The Upper Hand

There is currently a lack of holistic support addressing physical, emotional and social well-being of living arrangements for the elderly. Being prepared is to wrestle back the upper hand for our own well-being. By being proactive, we make sure that the necessary structure, support and resources are in place for a safe and comfortable living, right to the very end.

The process itself is an exercise in balancing what we want vs what is realistic. Make friends with your future self and use some imagination to project and forecast your needs. Take time to understand and explore the various offerings. It makes sense to keep abreast of developments affecting lifestyle and living, and most importantly, be creative about it.

Catering to the living arrangements of rapidly ageing society is uncharted territory. This means there are opportunities for new and better solutions, and we should all be part of it.

Let’s imagine!

Savvy Maverick

(Main image: Ian MacDonald, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.