Why BYOB Should Be Your Guiding Motto In Life

Life is a party, BYOB! Just kidding. By BYOB I don’t mean…Bring Your Own Booze instead what I mean is ‘Be Your Own Boss’. This is singularly the best and most sensible motto to have in life.

Fired!

The recent acquisition drama of Twitter by Elon Musk ending in mass firing last Friday is a case in point to the volatility entrenched in our corporate culture today. To hear some ex- Twitter employees, fired unceremoniously via email, say that the end came as a relief ending months of uncertainty and speculation show how mentally exhausting it must have been, waiting for the knife to drop. I wonder how many of them were already quiet quitting before the public debacle?

It doesn’t matter how high in the pecking order you are, everyone is susceptible to being axed. Even board members. The entire Twitter board was dissolved by Musk right after he took ownership. To be at another’s mercy and be so helpless, yet dependent upon for a pay cheque, is frustrating and demeaning to say the least. As many as half of the 7,500 global workforce were terminated, resulting in more than 3,000 folks being out in the cold, battling soaring living expenses, escalating inflation and a recession dying to rear its head.

In Singapore, Twitter had announced as recent as January 2022 that it would be hiring 50 new staff to double its pool of engineers at its engineering hub there. Imagine leaving a cushy job to take up position at a cool tech company only to be fired in less than 10 months. Ouch, painful! Welcome to the hire-and-fire world of work.

What Now?

Twitter is not the only organisation firing. In a sign of hard times ahead, stellar companies like Amazon, Apple, Meta (Facebook), Alphabet (Google) have announced hiring freeze. Other equally stellar names such as Microsoft, Shopify, Stripe, Netflix are joining the bandwagon to offload staff.

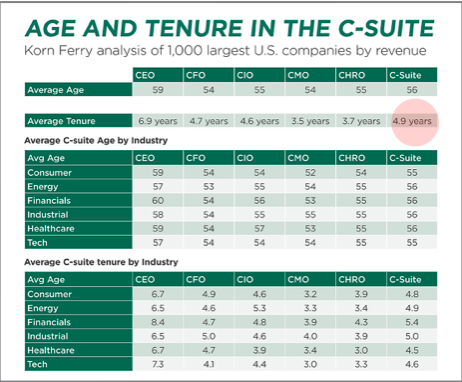

In a corporate environment where average tenure of C-suite holders is a mere 4.9 years, as borne out in a 2020 survey by Korn Ferry, it doesn’t bode well for the employed. It is hence imperative to full-proof yourself, regardless of seniority. The sooner you adopt the BYOB strategy, the more resilient you are against such calamity.

BYOB

What does Be Your Own Boss mean? Taken literally, it means starting your own company which gives more power and control than working for others. Whilst this is a possible route, I personally think entrepreneurship is 1 of the hardest endeavours in life. It is much harder than being a regular employee who only has to deal with the s*** that are within the perimeter of his job.

The smarter way to become your own boss is by generating passive income so you are not incumbent to anyone for your wellbeing. This is a powerful way to take control of your life and destiny. And it should be undertaken while in active employ. I know, I know, I’d been through the corporate cycle and understand that work responsibilities can be so overwhelming that even thinking about it is not possible, let alone embarking on it. So what can you do?

Thanks to technology, starting a passive income has become easier, a lot easier. And there are different types of passive income to match your personal circumstance and interest. No matter how busy you are in your day job, create room to buffer yourself against the harsh realities of the corporate world. Burying your head in the sand does not make the danger go away, in fact it’s suicidal. Your best bet is to be ready for whatever comes, whenever it happens. One thing’s for sure: not taking action means you will continue to be a puppet on someone else’s strings.

Passive Income

Besides boosting your main source of income, passive income helps you to:

- Diversify your income and protect your lifestyle

- Earn extra income so you can start saving and investing to reach your financial and life goals sooner.

- Enjoy the ‘nice-to-have’ things in life like a part-time cleaner, more exotic vacations, more frequent dining at fancy restaurants.

- Tap on your hidden talent instead of being a 1-trick-pony.

- Learn new skills with financial pay-offs that fast track wealth building and accumulation.

- Sharpen communication and interpersonal skills by interacting with those outside work.

- Stay abreast on new development socially, economically, politically and technologically.

- Widen exposure and add another (more interesting) dimension to life.

- Extend your social circle and network beyond the usual suspects.

- Make better life choices, eg resign, change job or retire on your own terms.

- Build your legacy for bequeathment.

- Have peace of mind knowing you have better control of your life

Not Created Equal

Not all passive income are the same. Some require more effort (direct ownership of rental property) compared to others (owning ETFs). Familiarise yourself with the various types of passive income so you can make a conscious and appropriate choice.

Contrary to the term, passive income is not ‘passive’ in such a way that no time or effort are required to maintain it. Keep the following considerations in mind when selecting the passive income you want:

- How much time can you allocate to manage it versus your work and family commitment?

- How much financial resource can you commit, at the start as well as ongoing?

- Take your interests into account as it should last many years.

- Know your risk appetite. Can you sleep when value of the investment plunge?

- Stay within your circle of competence.

- Do you have any geographical bias?

Get Started

Passive income can be derived from something as simple as investing in a broad-market index fund like the SPDR. It is the oldest tracker fund and since its inception, has returned a compounded annual return of 9.71%. I share this as I would my 23-year-old self.

This is not an investment recommendation or advice so please do your own due diligence and consult with accredited financial advisors. I mention this from my own experience and as an example as to how you can begin investing, even with limited funds to start generating passive income.

So get started. Who knows? You may be able to bring your own booze to the farewell party at work after all 🙂

Who’s the boss?

Savvy Maverick

(Main image: Savvy Maverick)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.

2 thoughts

Cheers 🥂. Always nice to read your essays.

(In Spain I’ll serve you a GT with Kyrö Napue gin from Finland 🙂

Thanks Ronald!

So cool that you will BYOB 🙂

Never heard of that gin before but absolutely look forward to try it.

Sante,

Savvy