Let 2022 Be The Start To Your Retirement Planning!

A brand new year is upon us! What better time than to make a fresh start, embark on new challenges and endeavours that will change your life? Why not let 2022 be the year you start retirement planning?

It is never too soon or too late to plan for retirement. The sooner you start, the more time you let your money and the compounding effect work for you. And the more time you have to fine tune, adjust and ready your mindset. Every dollar invested today starts working for you versus a dollar invested in the future.

Many are put off by retirement planning because of the complexity and myriad of decisions to think about:

-

-

- What are my needs in retirement?

- How best to start saving for it?

- Where can I learn how to invest?

- What should I invest in that fit my risk appetite, time capacity and interest?

- What are the blind spots I should look out for?

- What are the assumptions I should I work with?

-

In other words, where does one even start?

Getting Started

The Retirement Canvas is a step-by-step guide to assemble the jigsaw pieces to create your dream retirement. Isn’t it cool to take a peep into the future and see yourself flourishing in it? Isn’t it exciting to imagine what your retirement years would be like? Are you not inspired to take action to make it happen?

But if going through the entire process is too hefty, here’s a way to short-circuit it by just figuring out the 2 most crucial aspects:

- The retirement lifestyle you want

- An estimation of the retirement budget to support that lifestyle

Retirement Lifestyle

Thinking about retirement lifestyle automatically takes into account your purpose in retirement. Having a purpose is crucial for overall wellbeing and emotional health in retirement. At the same time, envisioning the lifestyle gives you an understanding of the financial resources needed to fund that lifestyle.

What the pandemic has highlighted is the importance of resilience in planning, to not be blind-sighted by unforeseen black swan events like a pandemic, government directive or environmental disaster.

From personal experience, the pandemic has forced my husband and I to rethink a 2nd home in Malaysia under the MM2H (Malaysia My 2nd Home) visa programme. As our main residence is in the Netherlands, the border closures, travel restrictions and quarantine requirement have made intercontinental travel a challenge and much costlier.

Planning early gives room to explore alternatives and adjust our plans accordingly, for example we are exploring Spain and Portugal where we can drive to instead of flying. The whole point about retirement planning is to ensure a deserving and fitting finale, making the years of toil, stress and sacrifices worth the while.

Retirement Budget

Most people let their financial situation dictate their lifestyle instead of specifying an ideal lifestyle and then putting in place a plan to make that a reality. I much prefer the latter, and the difference is in the planning and taking action.

Take account of your retirement lifestyle to work out a realistic retirement budget. The big components are:

- Housing – This varies depending on country/city, housing type, location (city, countryside, beach front). Even if mortgage is paid off, there will be expenses like painting, repairs and replacement of old apparatus. Will you retire in another country for better weather or to stretch your retirement dollars? Will you downsize once the nest is empty? Do some research to ascertain a ballpark expense.

- Healthcare costs and medical insurance – Are you adequately covered, especially after leaving employment? Do you need to supplement with private insurance plans? Can you top-up to extend coverage to overseas if relocating?

- Food and Transport – both categories can be higher or lower than your current level of expenditure depending on your retirement lifestyle, ie do you plan to entertain and eat out more or do you prefer a quieter lifestyle with more home-cooked meals?

- Travel, hobbies and entertainment – be it cruises, golf, dance or music classes, factor these into your retirement budget for a realistic representation.

- One-off expenditure and emergency needs – such as renovation, car upgrade, children’s wedding etc with an additional stash for unforeseen needs such as roof repair.

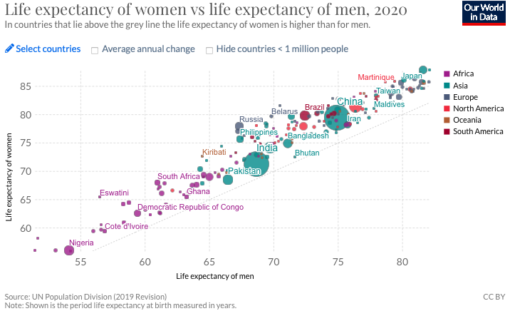

- Inflation and longevity – don’t forget to factor in at least 2% annual inflation and take into account longer life expectancy. Your savings and investment returns must at least make up for the decreasing value of money so you do not run out of funds. Click on this interactive link to see the life expectancy in your country: https://ourworldindata.org/grapher/life-expectancy-of-women-vs-life-expectancy-of-women

Your Life, Your Choice

Some people advocate higher costs in the first third of retirement and scaling down gradually as mobility decreases. Others prefer the escalating cost model as they believe healthcare cost will increase as the years go by. Yet others go on fixed level budget, holding costs the same throughout retirement years.

I fall into the last category as I like to keep things simple. Even though I believe that medical and longterm care costs will increase in older years, these will be compensated by reduced expenditure in entertainment, travel, transport, food etc.

Which method you favour is less important than the fact that you define a retirement budget and start to build it. As retirement nears, your vision and choices will become clearer and you can adjust accordingly.

I intend to continue investing for passive income for as long as my mental and physical capacity allow as I draw much satisfaction, purpose and enjoyment from managing an investment portfolio, jointly with my husband. It keeps us connected to the wider economies at large, we learn, it provides for a bigger and better lifestyle in retirement and will enable us to leave a good legacy.

So get started! By simply figuring out these 2 aspects, it would be good enough to have a grasp of your retirement wants and needs. You can then start saving and investing for it. Yes, saving alone is not enough, you must invest.

While some level of financial knowledge is needed, investing need not be complicated. Getting educated on basic financial concepts and tools should suffice to assess risks against rewards and knowing enough to work within your competency and comfort. Then let time and compounding do the rest. Apply the KISS principle so you can live life to the fullest while preparing for a great retirement!

Have started planning for your retirement? What have been your challenges? If you have not started, what are your concerns? Feel free to share by leaving a comment or get in touch with me at: sm@rt.today

New year, new aspirations,

Savvy Maverick

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is highly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.

2 thoughts

I blog frequently and I really thank you for your information. Your article has really peaked my interest. I am going to take a note of your site and keep checking for new information about once per week. I opted in for your Feed too.

Hi Jesus,

Glad you find the topic interesting. Hope it adds to your retirement planning and I would love to hear of any sharing or progress.

Cheers,

Savvy